Beginning July 1, 2025, China will implement a ban on the export of rare earth alloys, magnets, and chemical mixtures—materials that are already refined and ready for use in advanced manufacturing. Unlike raw ores, these processed components are essential to high-tech and defense manufacturing.

This policy shift introduces significant uncertainty into global supply chains. Manufacturers worldwide, especially those in sectors heavily dependent on rare earth technologies, now face mounting concerns over the reliability of access to these strategic inputs.

Why is China banning rare earth metal exports?

China’s suspension of critical mineral exports emerges as a strategic lever in their escalating trade dispute with the United States. According to Reuters, the move was widely seen as retaliation for U.S. tariffs, has already disrupted supply chains vital to automotive, aerospace, semiconductor, and defense industries. German, American, and Indian automakers have joined forces in warning that without rapid resumption of supplies, production line shutdowns and component shortages are expected. This hard-power economic tactic underscores Beijing’s broader geopolitical ambition to leverage its dominance in critical minerals.

What minerals are affected by the China export ban?

China’s export ban specifically targets refined rare earth products rather than raw ores alone. The most notable categories include:

Rare earths are a family of 17 elements, including neodymium, praseodymium, lanthanum, and cerium, that undergo extensive processing into high-value refined formats. These processed materials are essential manufacturing inputs, with critical applications.

Neodymium and praseodymium magnets power:

- Electric vehicle motors

- Wind turbine generators

Lanthanum and cerium alloys are used in:

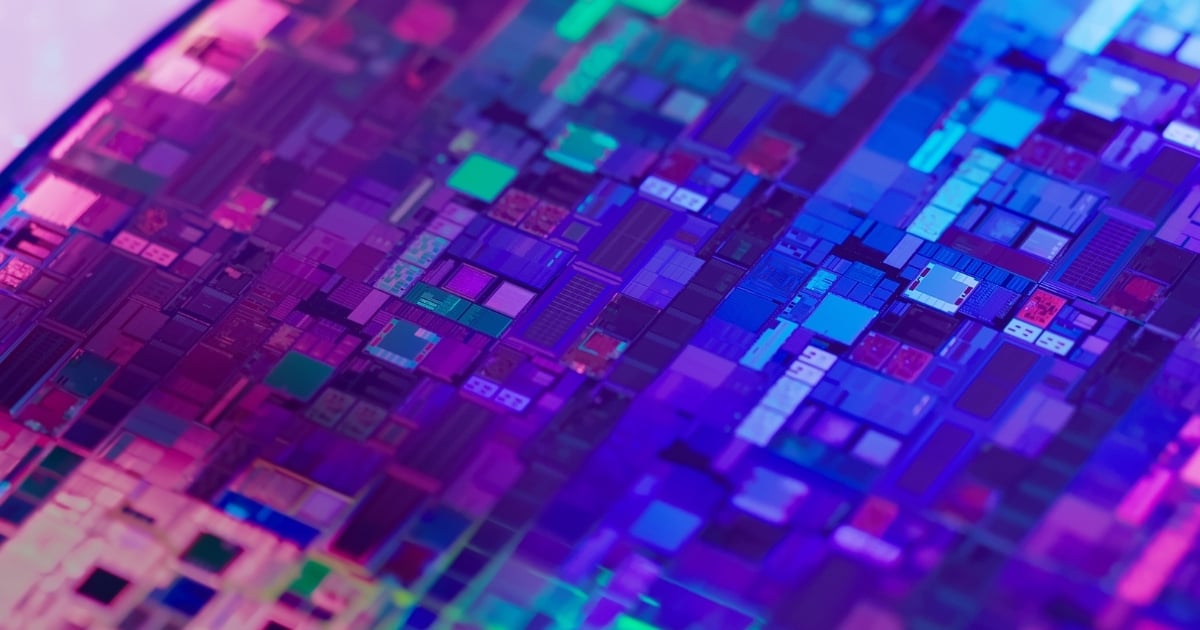

- Semiconductor fabrication

- Aircraft engines

- Medical imaging and diagnostic devices

By focusing the ban on refined components, which form the backbone of modern industrial supply chains, China’s action threatens the availability of raw materials and directly undermines global manufacturing capacity.

What does this mean for manufacturers?

China’s new export restrictions on rare earths create immediate challenges for manufacturers, including:

- Sourcing delays due to a new non-automatic licensing regime

- Extended lead times of 30 to 60 days for export permits

- Rising costs and reduced visibility into material origins

These issues are intensified by growing compliance pressures.

Manufacturers must:

- Adapt to evolving regulations on critical minerals

- Ensure alignment with national and global standards

- Improve traceability to avoid regulatory and competitive setbacks

Companies that fail to respond may fall behind in both legal compliance and market position.

How can companies respond to rare earth supply chain disruptions?

To stay ahead of disruptions like China’s rare earth export ban, companies need more than reactive sourcing—they need visibility into the materials they use, where those materials come from, and how shifting regulations may affect future access.

- Start with Full Material Declarations (FMDs) to gain insight into product composition and support compliance with emerging regulations.

- Map your supply chain to build a multi-tiered view of suppliers, uncover dependencies, and identify upstream risks that are often hidden.

- Trace material origins to understand where rare earths are sourced, evaluate geopolitical exposure, and verify responsible sourcing practices.

- Assess sourcing alternatives using material data and supplier insights to identify viable substitutes or secondary sources.

- Monitor regulatory developments to proactively align sourcing strategies and avoid compliance gaps or delays.

These steps allow manufacturers to move from reactive to strategic—building resilient supply chains that can withstand growing volatility.

Strengthen your supply chain with complete compliance solutions from Source Intelligence

Disruptions like China’s rare earth export ban require more than point solutions—they demand a complete compliance platform that delivers visibility, traceability, and action.

Our Extended Producer Responsibility (EPR) solution simplifies compliance for products containing rare earths, including electronics, packaging, and batteries. Built-in templates and automated data collation help your team stay ahead of evolving global regulations.

Our Minerals Reporting & Due Diligence solution enables supplier-level traceability and responsible sourcing. Collect and verify data, trace critical materials to their origin, and align with frameworks like the OECD Due Diligence Guidance.

These solutions are part of our complete compliance and sustainability software—a centralized platform that helps you stay agile as regulations shift. With superior FMD capabilities and advanced supply chain mapping, Source Intelligence gives you the insight to assess risks, explore alternatives, and respond proactively to global trade changes.

![]()