What is a Reasonable Country of Origin Inquiry (RCOI)?

A Reasonable Country of Origin Inquiry (RCOI) is conducted to determine whether its in-scope 3TG content originated in the Democratic Republic of the Congo (DRC) or one of the covered countries or is from recycled or scrap sources.

What constitutes a reasonable inquiry for a particular company will depend on various factors, such as the company’s size, its products, and its relationship with suppliers and supply chain visibility at the time. The RCOI may be satisfied by obtaining reasonably reliable representations indicating the facility at which the 3TG was processed and demonstrating that it did not originate in a covered country or that it came from recycled or scrap sources.

The Reasonable Country Of Origin inquiry process

If you have initiated your conflict minerals compliance program, you likely began your process by carefully filtering your products to identify those that may contain gold, tin, tantalum, and tungsten (3TG) necessary to functionality or production.¹ Based on this focused list, you are now ready to initiate a Reasonable Country of Origin Inquiry (RCOI) by working with companies throughout your supply chain.

Depending on the number of products requiring investigation and the complexity of the associated supply chains, an RCOI could involve hundreds or even thousands of telephone and email inquiries, data requests, data files, and other supporting documents. To effectively highlight areas of risk and provide auditable evidence of your due diligence process, these efforts and the resulting data must be well-organized and continuously reviewed and assessed.

Biggest challenges of the RCOI process

Key hurdles you may run into throughout the process include:

- Supplier response rates

- Requests for confidentiality

- Missing and erroneous data

- Discovery of red flags, which warrant further investigation²

The Final Rule does not explicitly state which actions and outcomes are needed to satisfy the RCOI requirement, arguing that such a determination depends on each SEC issuer’s particular facts and circumstances.

Per the SEC, the RCOI process can differ depending on an issuer’s size, products, relationships with suppliers, or other factors and will evolve over time depending on available infrastructure. However, per the general standards provided in the Final Rule, the RCOI must be reasonably designed to determine whether the issuer’s conflict minerals did originate in the Covered Countries³ or come from recycled or scrap sources, and it must be performed in good faith.

More specifically, the RCOI requirement is satisfied if the issuer seeks and obtains reasonably reliable representations indicating the facility at which its conflict minerals were processed, and demonstrating that those conflict minerals did not originate in the Covered Countries or came from recycled or scrap sources. These representations could come either directly from that facility or indirectly through the issuer’s immediate suppliers, but the issuer must have a reason to believe these representations are true given the facts and circumstances surrounding those representations.⁴

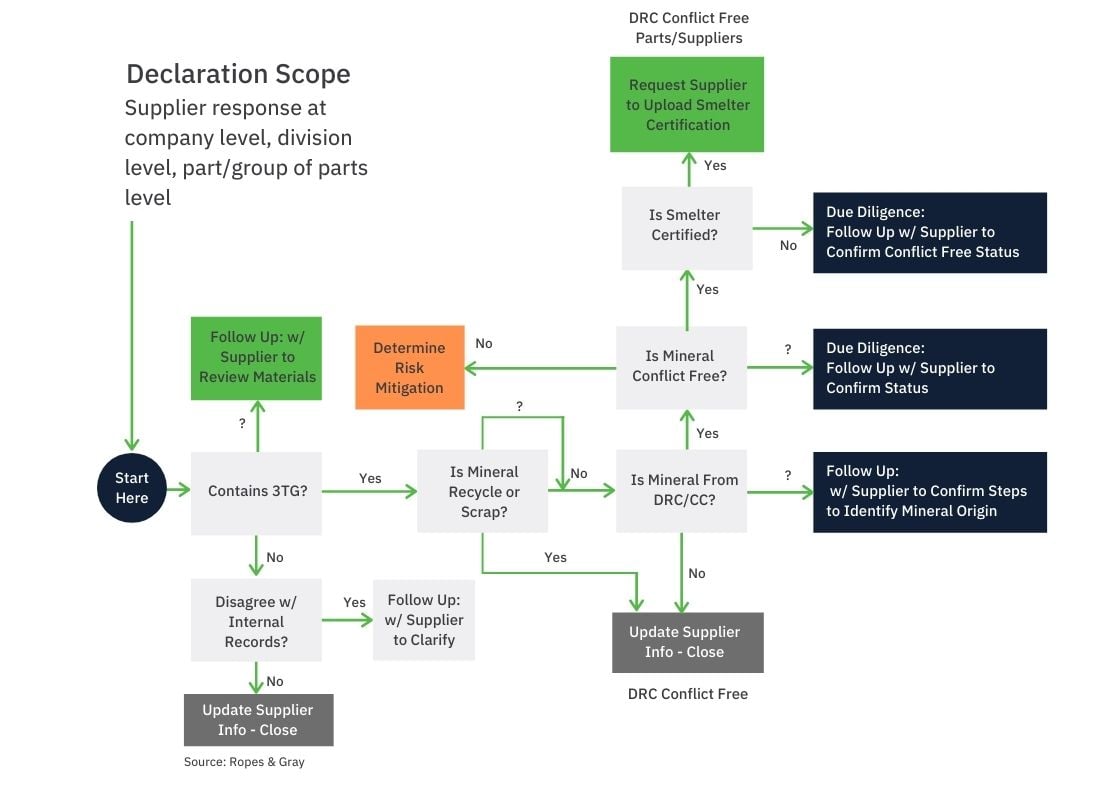

Put more simply, organizations must trace the origin of necessary conflict minerals in their products back to the smelter or processing facility and must document the results of this trace. If an issuer learns through its RCOI that its products have conflict minerals that are necessary, originated in the Covered Countries, and did not come from recycled or scrap sources, they must proceed to the next step in the compliance process, Due Diligence.

Additionally, if an issuer has reason to believe that its necessary conflict minerals may have originated in the Covered Countries (and may not have come from recycled or scrap sources) based on the RCOI, the Due Diligence process is triggered.

Below we cover practical steps organizations may take to fulfill the RCOI requirements.

RCOI essential elements for success

The goal of an RCOI is to trace the origins of necessary conflict minerals in your products and gather intelligence as to whether these minerals came from the DRC or adjoining countries. The essential elements of an Reasonable Country of Origin Inquiry are:

- Identifying and engaging relevant suppliers

- Data collection and management

- Quality assurance

- Assessment to determine whether further Due Diligence is required

1. Identifying supplier contacts

Based on your list of products requiring 3TG tracing, contact information for the relevant individuals at your Tier One suppliers should be assembled (names, telephone numbers, and email addresses).

Although this may seem like a simple step, our experience indicates fairly extensive contacts may be required to pinpoint the best person within an organization to engage on conflict minerals and to establish effective lines of communication. Most companies only have a contact that acts as an account manager, so the work of tracking down the proper contact could take some time and effort.

Discrepancies in part numbers (e.g., typographic errors, discontinued parts, inaccurate cross-walks between internal and supplier unique IDs) can also complicate the process. If possible, communications should include both your own internal P/N as well as the P/N of your supplier so that cross-referencing later on will be easier. We recommend building additional lead-time into the compliance process to account for these potential initial roadblocks.

2. Engaging suppliers

Once the appropriate points of contact within Tier One suppliers are identified, a good practice is to provide background information on the Conflict Minerals regulation itself. Depending on your industry and products, some or even many of your suppliers may have limited or no knowledge of the regulation and its provisions (e.g., private companies and those located outside the U.S.).

In addition to a 24/7 multilingual supplier education and engagement team, Source Intelligence uses its cloud based platform to house information on the Conflict Minerals Rule requirements that suppliers can access throughout the data collection process if they have questions. It is also useful to provide an overview of your compliance program and its goals and requirements.

The importance of receiving timely and accurate information should be stressed, for example, by including a letter from a senior executive within your organization in your initial communications and data requests. Suppliers may be at first hesitant to provide the information they consider confidential and critical to their business advantage and success. It will be important therefore to include mechanisms in your program to allow for supplier confidentiality, anonymity, and potentially the execution of Non-Disclosure Agreements (NDAs).

Defining an escalation process is also recommended to address non-responders. No matter who at your organization, or third-party service provider, is handling the program, the first introduction should come from a person with whom the supplier is familiar. Seeing a name they know will increase the likelihood that a supplier will read the email and respond.

3. Data collection and management

Once your program has been introduced to your suppliers and lines of communication established, data collection can begin. The Conflict Minerals Reporting Template 6.22 is the current industry standard for collecting conflict minerals information up the supply chain, but it is not the only solution for data collection.

Regardless of the method or platform used, key information to obtain includes:

- The location of the facility or facilities that are associated with the production or storage of the products being traced

- A list of materials that are included in the products which may contain conflict minerals or where conflict minerals may be necessary in the production process

- Contact information for the companies supplying the materials that meet the criteria above.

This process should continue until the smelters or refiners of recycled or scrap materials have been identified.

It should be expected that multiple telephone numbers and/or email contacts will be required to complete the data collection process with a given supplier and that communications, surveys, and templates will need to be provided in multiple languages. Meetings and telephone contacts to follow-up on missing data and questions will need to be scheduled appropriately based on time zones.

4. Data assurance and assessment

Although successfully engaging suppliers and obtaining required data may be one of the biggest challenges you face throughout the compliance process, you will also need procedures for data quality and control. Completed templates and surveys need to be reviewed for accuracy and missing data. Verifying responses and obtaining additional information may require several iterations of follow-up just within the first tier of your supply chain.

At a minimum, you should expect to spend an hour to 90 minutes of time per supplier to collect the required information. Remember, you will also likely need to follow up with suppliers on a regular basis, such as each quarter, to understand if there have been any changes in their supply chains. Though this time commitment is spread out over the course of the year, it can quickly become a very significant use of human resources when dealing with large supply chains.

You will also need mechanisms to track the outcomes of your telephone and email queries so you can easily determine which items are closed and which still need to be addressed. Building these tracking systems after the data collection has begun will not be as efficient as having them ready to go from day one.

One area where we experience a significant need for fact-checking is in the identification of smelters and refiners noted in templates. We have found that as high as 40% of smelters noted for a given component are in fact other types of companies such as semiconductor fabricators, solder manufactures, or metal traders.

In addition, the names of smelters as provided by your suppliers will vary as much as the spelling of words before Merriam-Webster. Having a robust database of smelter aliases, both known smelters and known non-smelters, will expedite this process. On average you can expect five or six different spellings of each smelter provided. Verifying smelter information may thus also include multiple telephone and email communications across locations worldwide, in addition to internet research.

Moving up the supply chain

While the RCOI essential elements described above require a significant input of resources, unfortunately, this is just the beginning.

These steps will have to be repeated up your supply chain until you feel you have enough information and documentation to support your stance that your RCOI was reasonably designed to determine the location of the smelters and processing facilities associated with your 3TG products and that your steps were performed in good faith.

Since the substance and outcome of your RCOI will be part of your SEC reporting, public perception of your efforts – or lack thereof – should be a critical risk management decision within your organization.

Depending on the complexity of your supply chain, you may interact with hundreds, or even thousands, of suppliers. Our experience shows it is not unreasonable to find a 50:1 ratio of sub-suppliers to a primary supplier. As such, managing the resulting email and telephone communications, surveys, and templates will require an agile data system.

Being able to easily analyze supplier data is also imperative to capitalize on redundancies, for example by sending a single data request to a supplier acting in separate supply chains associated with your products. Strong data management is also an essential requirement for auditable evidence in the case of supply chains being moved forward to the Due Diligence process. Since this will include 3TG products for which you are unable to rule out the possibility of a DRC-origin of conflict minerals during the RCOI, it could potentially include a significant amount of products and suppliers in this first year of compliance activities.

Conclusion

Clearly, the RCOI conducted by your organization will be a cornerstone of your conflict minerals compliance program. Not only will it require a significant amount of labor and other resources, but it should be viewed as your “first pass” at identifying conflict minerals risks hidden within your supply chain.

Successfully identifying these risks will require a thorough, well-organized system of data collection, and reasoned review of the collected information. The number of products and suppliers passed to the Due Diligence process will subsequently impact the level of work required in auditing and reporting, highlighting the criticality of an RCOI done right the first time.

Source Intelligence’s award-winning US and EU Conflict Minerals Program uses a cloud based platform in combination with a supplier engagement team to automate the entire due diligence process. We take the heavy lifting off your plate by:

- Tracing your entire supply chain

- Identifying and verifying smelters

- Collecting CMRTs and documentation

- Using AI to verify documents and identify risk

- Rolling up all collected data into dynamic reports

- Providing resources and education to your supplier and smelters

Request a demo to see for yourself how our conflict minerals program can make the RCOI process and conflict minerals compliance a breeze.

[1] Product Filtering: A Critical first Step in Conflict Mineral Compliance, A Source Intelligence Technical White Paper, February 2013. Product Filtering A Critical First Step in Conflict Minerals Compliance White Paper

[2] 17 CFR 240 and 249B.

[3] The “Covered Countries” include the Democratic Republic of the Congo (DRC) or an adjoining country. The term “adjoining country” is defined as a country that shares an internationally recognized border with the DRC, which presently includes Angola, Burundi, Central African Republic, the Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda, and Zambia.

[4] Per the Final Rule, an issuer would have reason to believe representations were true if a processing facility received a “conflict-free” designation by a recognized industry group that requires an independent private sector audit of the smelter, or an individual processing facility which has obtained an independent private sector audit that is made publicly available.

By: Michelle Turner, MS, PhD Tristan Mecham, MPIA Jennifer Kraus, MPH, PhD

%20(1).jpg)