What Are the Different ESG Frameworks?

According to the Global Sustainable Investment Alliance (GSIA) 2018 review, “Globally, sustainable investing assets in the five major markets stood at $30.7 trillion at the start of 2018, a 34 percent increase in two years.”

Environmental, Social, and Governance (ESG) factors have become key drivers of value, proving that financial performance is no longer measured only in terms of market size and profit. - Click to Tweet

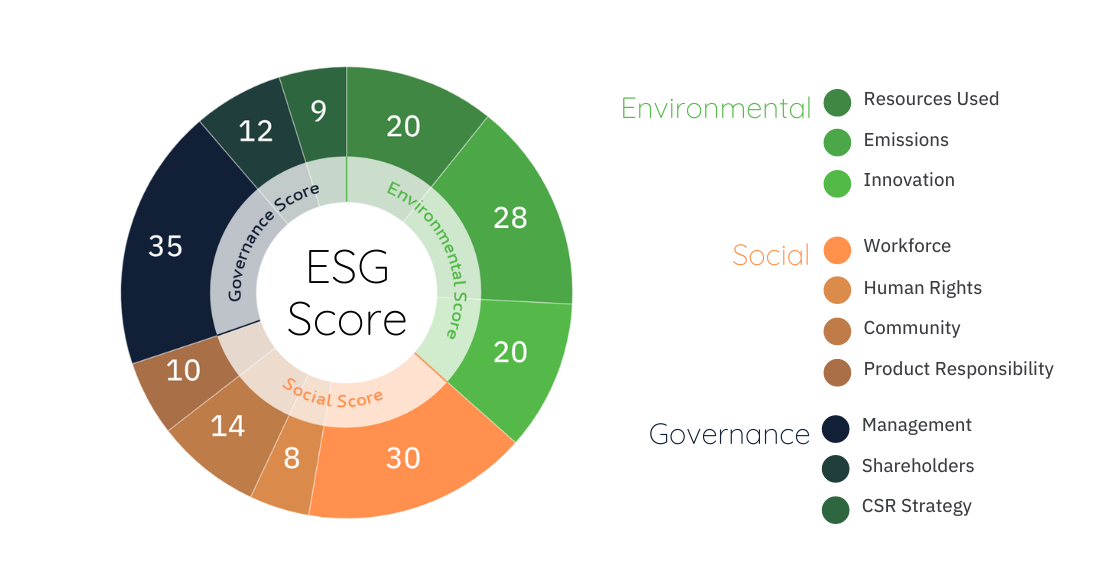

For the past two decades, pressure has increased to lead organizations toward more transparency and accountability. Sustainability issues are a concern across the full spectrum of stakeholders: customers, employees, suppliers, shareholders, and communities. This year’s events bring forth the renewed urgency to adopt and enforce business core values to protect human rights, health, and the environment and corporate behavior, the very pillars of ESG:

- Environmental Responsibility, which includes energy use, waste management, and climate change.

- Social Responsibility, including labor relations, human rights, diversity and inclusion, and product liability.

- Governance, which includes compliance, business ethics, controls, and procedures.

In light of the impact of ESG factors on long-term growth, many companies have already integrated ESG reporting in their CSR strategies, while others struggle to fully measure the “what” and “how” of the matter. Truth be told, the diversity of ESG frameworks is confusing, and setting up a reporting system that covers the metrics most relevant to your industry can be overwhelming.

This article will outline the ESG frameworks most in use today and point you in the right direction to implement efficient and pertinent reporting.

The Global Reporting Initiative (GRI)

Created in 1997, the GRI was the first and most widely used frameworks. Its objectives were to provide companies with accountability standards metrics so they could in turn show their responsible environmental practices. Later, metrics were expanded to include human rights, governance, and social well-being.

To date, this framework is one of the most holistic approaches by working with stakeholders to determine how a company affects the world.

United Nations Sustainable Development Goals (SDGs)

Adopted by member states in 2015 within the bigger picture of the 2030 Agenda for Sustainable Development, the SDGs address global challenges in the form of 17 goals aimed at creating a better future for people and the planet, some of which include:

- eradicating hunger and poverty

- strengthening environmental protection

- achieving peace

- widening access to education

- encouraging responsible consumption

Accepted worldwide as an ESG framework that brings reporting to a more comprehensive level, its broad nature lacks the guidelines to measure industry-specific indicators.

Morgan Stanley Capital International

Of the ESG frameworks designed more specifically to inform investment decisions, the one created by financial services company Morgan Stanley is the most aggressive, as it measures long-term resilience and ESG risks through a scoring system. From CCC (laggard) to AAA (leader), their ratings parse over 1,000 data points for risk exposure on 80 industry-specific and geographic metrics.

The MSCI ESG ratings are useful if you are an institutional investor looking to build a portfolio or establish benchmarking, less so if you’re looking for a methodology that can support your Corporate Social Responsibility efforts for reputational and communication purposes.

The Sustainability Accounting Standards Board (SASB)

In 2018, the Board published a set of ESG standards specific to 77 industries, each with a set of financially material topics and associated metrics. Again, this ESG framework is designed for companies and investors needing to analyze how ESG issues may impact financial performance.

As such, SASB is a great complement to other ESG initiatives.

Challenges When Adopting ESG Frameworks

To date, it appears that picking out a single framework may not be conducive to covering all bases, although that may depend on the objectives and size of a company. Large and/or publicly traded companies are submitted to various disclosure requirements to which they may attach ESG reports. For most, however, challenges exist both in scope and deployment. Considering the weight ESG factors have over financial and social sustainability, rushing into the process is counter-productive. ESG reporting should be considered a strategic endeavor destined to improve business performance rather than impede it.

Some of the most hindering obstacles to meaningful reporting directly stem from the ESG framework themselves, others arise at a later stage.

Different Methodology and Scoring System

ESG frameworks all follow a different methodology resulting in many scoring systems and data interpretations. Should you decide to use only one, it’s crucial to dissect the impact of each metric pertaining to your sector of activity and your goals.

Scores may vary significantly between frameworks, hereby losing their insight value, as if we were comparing the performance of a baseball team with those of a volleyball team.

Lack of Harmonization

There is a distinct lack of harmonized standards between ESG rating frameworks, which may complicate the task when operating on a global scale. Are there specific requirements attached to ESG reporting in a country where you operate?

To fully grasp how ESG reporting may create issues, one has to understand that should you choose to report, you expose your business to liability. By becoming public, even voluntary disclosures become subject to scrutiny, questioning, or legal repercussions.

Data Quality

Regardless of the lack of harmonization or overlapping standards that create redundancies, the quality of your ESG score will be measured against the quality of the data you collect, along with the methodology you chose and the material issues you wish to address.

All the data on ESG factors is readily available in your supply chain, provided you implemented a solid process to not just extract and collect, but also aggregate, centralize and analyze, not just for the benefit of compliance or transparency, but also for risk management. Then, and only then, can you practically look at which ESG reporting makes the most sense.

Gearing Up for ESG Reporting

There is no arguing that profit and return on equity are relegated to the closet of vintage KPIs where financial health is concerned. Like any vintage piece, you wear it as an accessory that compliments and subtly enhances a modern outfit. If fashion metaphors are not your thing, consider the shift from investing to ESG-investing, a term now widely established in financial jargon.

As McKinsey states in its article Five Ways ESG Creates Value:

“A strong ESG proposition correlates with higher equity returns, from both a tilt and momentum perspective.” - Click to Tweet

At Source Intelligence, we know embracing new business paradigms is not easy. We know the myriad of programs, initiatives to inspire from, choosing ESG frameworks, and starting ESG reporting is overwhelming and confusing. We also know it is by no means impossible to achieve with the right tools and support. In our latest white paper, How to Turn ESG Reporting Into Your Best Asset: A How To Guide, we outline how you can:

- Take charge of your supply chain

- Integrate your supply chain data to work seamlessly with ESG indicators

- Decide which framework(s) best fits your industry and goals

- Set up ESG reporting for long-term success

Download our white paper to learn more about ESG Reporting or request a demo to see what our ESG solutions can do for you.

About the author

Source Intelligence

![]()

Source Intelligence is the leading provider of supply chain compliance software for sustainability and ESG programs. Built for mid-market and enterprise manufacturers, its configurable SaaS platform centralizes supply chain data and automates regulatory workflows as requirements scale. From product compliance and responsible sourcing to Extended Producer Responsibility (EPR) and component obsolescence, Source Intelligence helps global teams reduce risk, improve visibility, and meet evolving obligations with confidence.